Are There Any Items You Cannot Bring Back to the Us From New Zealand

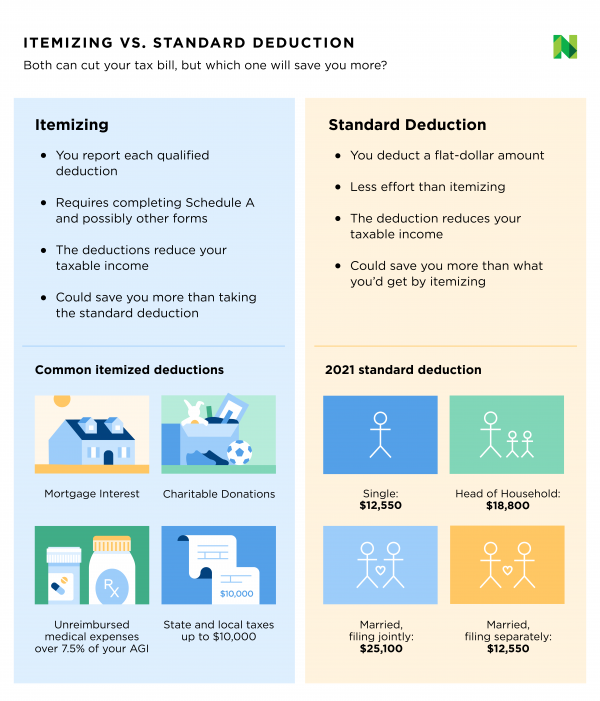

Itemized deductions are tax deductions that you take for various expenses you incurred during the tax year. They can sometimes exceed the standard deduction, meaning that itemizing on your tax return can make a huge difference in your tax bill.

But itemized deductions aren't necessarily no-brainers. Here are some things you need to know about what itemized deductions are and what it means to itemize on your tax return.

-

The standard deduction , which is the itemized deduction's counterpart, is basically a flat-dollar, no-questions-asked reduction in your adjusted gross income .

-

You can take either the standard deduction or itemized deductions on your tax return. You can't do both. The question is which method saves you more money.

-

Here's what it boils down to: If your standard deduction is less than your itemized deductions, you probably should itemize. If your standard deduction is more than your itemized deductions, it might be worth it to take the standard deduction and save some time.

| Pricing: $47.95 to $94.95, plus state costs. Free version? Yes. | |

| Pricing: $60 to $120, plus state costs. Free version? Yes. | |

| Pricing: $49.99 to $109.99, plus state costs. Free version? Yes. |

What it means to have itemized deductions on your tax return

-

Itemized deductions are basically expenses allowed by the IRS that can decrease your taxable income.

-

When you itemize on your tax return, you opt to pick and choose from the multitude of individual tax deductions out there instead of taking the flat-dollar standard deduction.

Advantages of itemized deductions

-

Itemized deductions might add up to more than the standard deduction. The more you can deduct, the less you'll pay in taxes, which is why some people itemize — the total of their itemized deductions is more than the standard deduction.

-

Some situations make itemizing especially attractive. If you own your home, for example, your itemized deductions for mortgage interest and property taxes may easily exceed the standard deduction, saving you money.

Disadvantages of itemized deductions

-

You have to understand the rules. Some itemized deductions come with a few hurdles, of course. If you have medical expenses, for example, you can only deduct the portion that exceeds 7.5% of your adjusted gross income.

-

You might have to spend more time on your tax return. If you itemize, you'll need to set aside extra time when preparing your returns to fill out the big enchilada of tax forms: the Form 1040 and Schedule A , as well as the supporting schedules that feed into those forms.

-

You need proof. You need to be able to substantiate your deductions. That means keeping records and being organized. If you normally take the standard deduction and are thinking of itemizing when preparing your return next year, start saving your receipts and other proof for your deductions now.

What it means to take the standard deduction

The standard deduction is basically a flat-dollar, no-questions-asked reduction in your adjusted gross income. When you take the standard deduction, you basically opt to take a flat-dollar deduction instead of picking and choosing from the multitudes of individual tax deductions out there.

Advantages of taking the standard deduction

Here are some big reasons people take the standard deduction instead of itemizing on their tax returns.

-

It's faster. Taking the standard deduction makes the tax-prep process relatively quick and easy, which probably is one reason most taxpayers take the standard deduction instead of itemizing.

-

It usually gets bigger every year. Congress sets the amount of the standard deduction, and it's typically adjusted every year for inflation.

| Filing status | 2021 tax year | 2022 tax year |

|---|---|---|

| Single | $12,550 | $12,950 |

| Married, filing jointly | $25,100 | $25,900 |

| Married, filing separately | $12,550 | $12,950 |

| Head of household | $18,800 | $19,400 |

-

Some people get more (or less). The standard deduction is higher for people over 65 or blind, though filing status is still a factor. And if someone can claim you as a dependent, you get a smaller standard deduction.

-

One note for married people: You can't take the standard deduction if you're married but filing separately and your spouse chooses to itemize. You both have to do the same thing — either itemize or take the standard deduction.

Should I itemize or take the standard deduction?

Here's what it boils down to: If your standard deduction is less than your itemized deductions, you probably should itemize and save money. If your standard deduction is more than your itemized deductions, it might be worth it to take the standard and save some time.

-

Run the numbers both ways. If you're using tax software , it's probably worth the time to answer all the questions about itemized deductions that might apply to you. Why? The software or your advisor can run your return both ways to see which method produces a lower tax bill. Even if you end up taking the standard deduction, at least you'll know you're coming out ahead.

Are There Any Items You Cannot Bring Back to the Us From New Zealand

Source: https://www.nerdwallet.com/article/taxes/itemized-deductions-standard-deduction

0 Response to "Are There Any Items You Cannot Bring Back to the Us From New Zealand"

Postar um comentário